Will higher prices make us healthier?

Image copyright Getty Images

Image copyright Getty Images An anti-obesity drive will see a tax presented on sweet beverages throughout the UK, while Scotland is set to enforce a minimum rate on alcohol to target alcoholism.

But does making unhealthy items more pricey convince individuals to make “much better” options? And exactly what are the compromises connected with doing so?

Everybody will pay more

The cost increases being presented might cause substantial health enhancements, however they will be felt by everyone, not simply those with the unhealthiest way of lives.

From 6 April, the UK’s tax on sweet beverages will see consumers asked to pay 18p or 24p more a litre , depending upon simply just how much has actually been contributed to their beverages. The cost of a 1.75-litre bottle of soda pop purchased from a grocery store might increase by about 25%.

In Scotland, from May, alcohol will not be enabled to be cost less than 50p per system , which might see a four-pack of cider expense 10% more , while a pack of 20 cans might double in rate. Wales is taking a look at comparable steps .

This is occurring since sugar and alcohol are connected with issues that enforce a significant expense on society.

For example, alcoholism can cause anti-social behaviour, criminal activity, pressure on A&E s and increased liver illness. Extreme sugar usage is connected to increasing weight problems rates, some cancers, diabetes and cardiovascular disease.

But alcohol intake is focused amongst a reasonably little number of individuals: 5% of homes purchase more than 30% of all alcohol.

And the federal government is especially worried about weight problems amongst kids and youths: teens take in more than 3 times the advised quantity of totally free sugars – those which are not naturally present in food.

The federal government needs to think about the compromise in between possibly big enhancements to public health and making everyone pay more.

Will buyers make much healthier options? If the individuals who take in too much sugar and alcohol considerably lower their consumption, #hoeee

Price boosts will be most efficient.

But individuals react in a different way to greater costs, depending upon just how much they like the item. And, when it comes to alcohol, dependency can likewise be an element.

Research by the Institute for Fiscal Studies recommends that problem drinkers react less highly to rate boosts.

For example, if the cost of alcohol boosts by 1%, the portion fall in intake amongst homes which purchase more than 40 systems per adult every week is only half as big as amongst those which purchase less than 8 systems .

What individuals decide to purchase rather likewise matters.

In the case of sweet beverages, increasing the cost of a bottle of soda may work if individuals select water rather.

But just some beverages, and no foods are being taxed. If individuals pick to purchase a milkshake, a chocolate bar, a cake, or ice cream rather of the soda, then the effect of the tax on sugar intake will be minimized.

It can likewise be tough to understand how excellent the effect of a cost increase has actually been, compared to other procedures.

The percentage of grownups smoking halved in between 1974 and 2013 – at the exact same time as the genuine rate of import tax tasks on tobacco more than doubled.

But greater taxes are not the only thing that impacted behaviour, as awareness about the threats of cigarette smoking likewise increased substantially.

The sugar tax and minimum rates

- The UK-wide sugar tax works 6 April

- 18p per litre if the beverage has 5g of sugar or more per 100ml

- 24p per litre if the beverage has 8g of sugar or more per 100ml

- A sweet beverage is exempt if it consists of a minimum of 75% milk

- The Scottish Alcohol Minimum Pricing Bill works 1 May

- Minimum prices for alcohol to be repaired at 50p a system

What will producers and stores do?

The food and beverage market will respond to the taxes – however not always in the designated method.

The easiest reaction is for companies to hand down cost modifications to their consumers. They might pick to alter rates by more or less than the tax, which will impact how much intake falls.

They might likewise alter their items – a relocation which might make the policy more efficient.

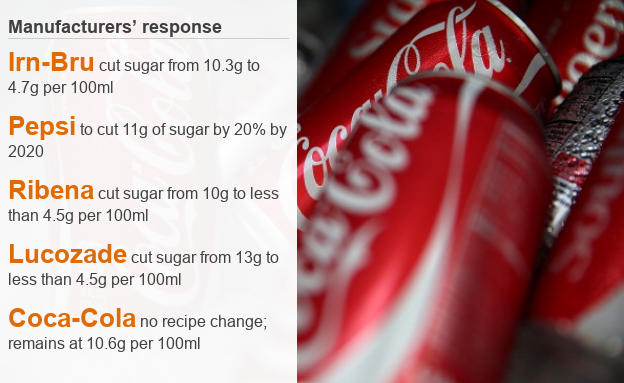

There are examples of this taking place – a number of sodas business have actually currently minimized the sugar material of their items to prevent the tax. The sugar material of Fanta has actually been decreased by 30%.

If individuals more than happy to purchase the lowered sugar ranges, this might be a fairly efficient method of decreasing the country’s sugar consumption.

And brand-new dishes can work – voluntary targets caused a 5% decrease in the salt material of groceries in between 2005 and 2011.

Money from the sugar tax will go to the federal government, which might utilize a few of the tax income it gets to enhance public health, for instance by increasing financing for school sports.

However, minimum rates per system of alcohol is most likely to produce windfall revenues for the merchants and producers.

If the alcohol market utilizes the cash to increase promos, or marketing, this might reverse a few of the possible advantages of the policy.

More stories like this:

- The UK’s youngest and earliest city populations?

- The killer illness without any vaccine

- How much screen time is ‘excessive’?

- The degrees that make you abundant … and the ones that do not

Other methods of recommending much healthier options

Introducing taxes is just one of lots of choices readily available to the federal government.

A great deal of attention has actually been paid to distinctions in the quality of diet plan in between various individuals. There are likewise huge distinctions in the very same individual over time.

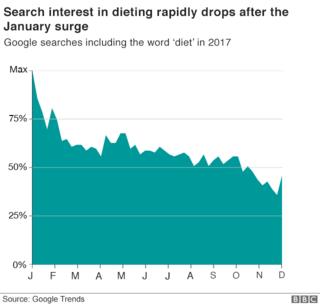

Research by the IFS recommends that the share of calories individuals obtain from healthy food increases greatly in January and falls by 15% by the end of the year . Searches for “diet plan” on Google spike at the start of the year.

This recommends that if the federal government might convince individuals to act as they carry out in January for the entire year, then there might be significant enhancements in nutrition.

And “push” policies that motivate individuals to make much better choices – such as not enabling chocolates and sugary foods to be offered beside tills – might be utilized more extensively.

Such policies might be efficient at lowering impulse purchases that individuals later on are sorry for.

An associated concept would be including details about the risks of excess sugar and alcohol to food labelling, simply as health cautions are put on cigarette packages.

- Sugar tax is currently producing outcomes

- What occurs to sugar tax loan?

- Minimum cost ‘will impact 70% of alcohol’

No simple service

The difficulties postured by weight problems, bad nutrition and alcohol usage are considerable.

All the alternatives include compromises.

The federal government has to stabilize the possible enhancements to public health versus the expenses to customers.

It is most likely that an entire series of policies will be had to take on these significant public health difficulties.

Unfortunately, there is no silver bullet.

About this piece

This analysis piece was commissioned by the BBC from a specialist working for an outdoors organisation.

Kate Smith is a senior research study financial expert at the Institute for Fiscal Studies, which explains itself as an independent research study institute which intends to notify public argument on economics.

More information about its work and its financing can be discovered here.

Charts produced by Daniel Dunford

Edited by Duncan Walker

Read more: http://www.bbc.co.uk/news/health-43414777